As an educational charity and visual arts organisation, Fabrica needed a tailored package of insurance that reflected its varied activities and events. To find out more, we spoke to Director Liz Whitehead.

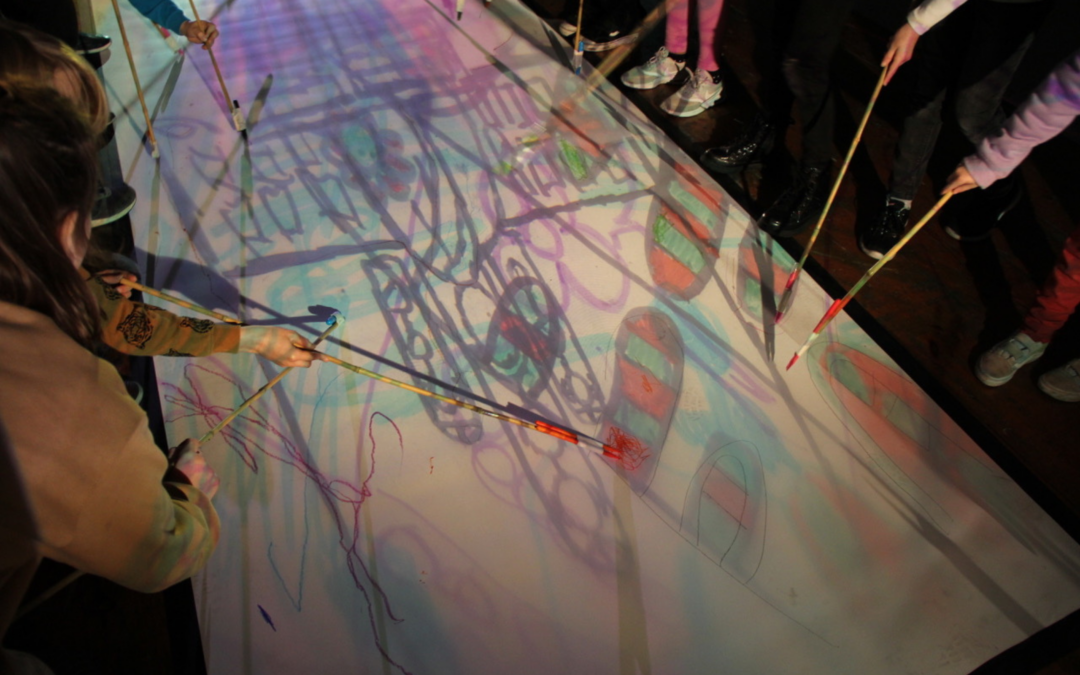

Based in the former Holy Trinity Chapel in central Brighton, Fabrica is a unique setting for exhibiting art. Founded in 1996 by a small group of Brighton-based artists and an administrator, Fabrica has used its building as a space for artists to create ambitious new exhibitions and experimental projects that extend the boundaries of their work. This attracts new audiences and acts as a catalyst for discussion and learning about art and artists.

But Fabrica also has another function. In addition to supporting artistic production, it also hosts a packed programme of events for the local community, including year-round educational and health and well-being activities. It has also been the venue for the first Community Connections event.

With such an eclectic mix of activities and purposes, finding insurance that could adapt to the gallery’s needs has been key. To learn more about Fabrica’s work and its insurance challenges, we got together with its director, Liz Whitehead.

Can you describe what Fabrica does and what its mission is?

We’re an educational charity working in the arts sector. We present high-quality visual art exhibitions, experimental projects and film screenings in our space – which is a Grade 2-listed, 19th century chapel – and create a wide range of learning activities for all ages using our artistic offer as a focus.

We witness the benefits of the arts in our volunteers, visitors and participants every day: as a visual, emotional and intellectual stimulation, and as a catalyst for creativity, learning and understanding about what it is to be human in the world. Over the years we’ve seen the really positive effect this has had on the mental health and well-being of the thousands of people we work with annually through our community programme.

What would you say your challenges are?

We rely on a mixed financial model and different income streams present different challenges. For example, we currently receive funding from Arts Council England, as well as being subcontracted by the lead provider for the UOK Brighton & Hove contract. The latter is funded by NHS Brighton and Hove CCG and Brighton and Hove City Council, because we run programmes of work that deliver health and well-being outcomes, such as Men in Sheds. We also earn our own income from hiring out the space.

The pandemic had a big impact on us too and the uncertainty around the future of public funding is very difficult to plan for. We’re a small team on limited resources but we always want to do more and improve what we do.

What are your challenges in terms of insurance?

In terms of insurance, what we do is quite niche, which means that there are peculiarities of risk. Public safety is a key consideration as we hold exhibitions and hire out the space. Every time we change the layout of the space we need to risk assess it. We also work with many volunteers throughout the year who help with the educational activities and our fundraising.

Finding an insurer who was willing to understand our needs and work through how these could be addressed was therefore really important.

How did Chris Knott Insurance help you to find the right insurance?

Chris Knott visited and spent time with me – they really got to grips with our business. And now that the insurance is in place, if I have any questions I can still ring up and speak to someone quickly as they’re not a big faceless call centre.

My cover can be easily adapted too. We hold three to four exhibitions a year that require the space to be completely reconfigured, and we sometimes use projection and sound equipment, but I can talk to them to adjust the levels of cover we need really quickly. We have a good working relationship.

What insurance do you now have in place?

We have Contents Insurance in place, which includes general contents as well as our computer equipment, in addition to Public Liability Insurance, Employers’ Liability Insurance, Business Interruption Insurance, Trustees Indemnity and Legal Expenses. Over the last year, we have also added in Hired Equipment cover for our exhibitions.

Would you recommend Chris Knott?

Yes, I would. I’m not an insurance specialist – I only look at insurance once a year, so it’s good to have a relationship with a broker and to not have to handle everything all by myself. And if something happens or there’s an issue, it’s easier to negotiate with the actual insurer if you have a broker. It puts you in a better position.

Do you need help with your Charity Insurance?

Chris Knott Insurance specialises in Charity Insurance and cover for other not-for-profits. To get the cover you need, speak to our experienced team on 0800 917 2274 or request a quote now.

Read another charity case study: The Pelham.